Low latency

peer-to-peer

on-chain swaps

Increasing efficiency 10x

For makers

Rule-based pricing engine

For takers

Execute on a price you see

On-chain settlement

Arbitrage fee

MEV-Resistant

MEV-Resistant

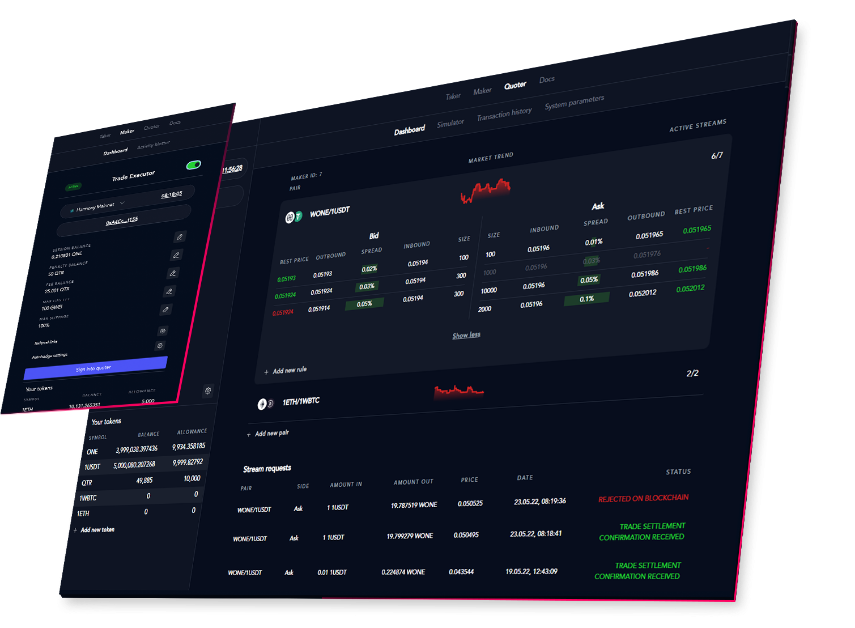

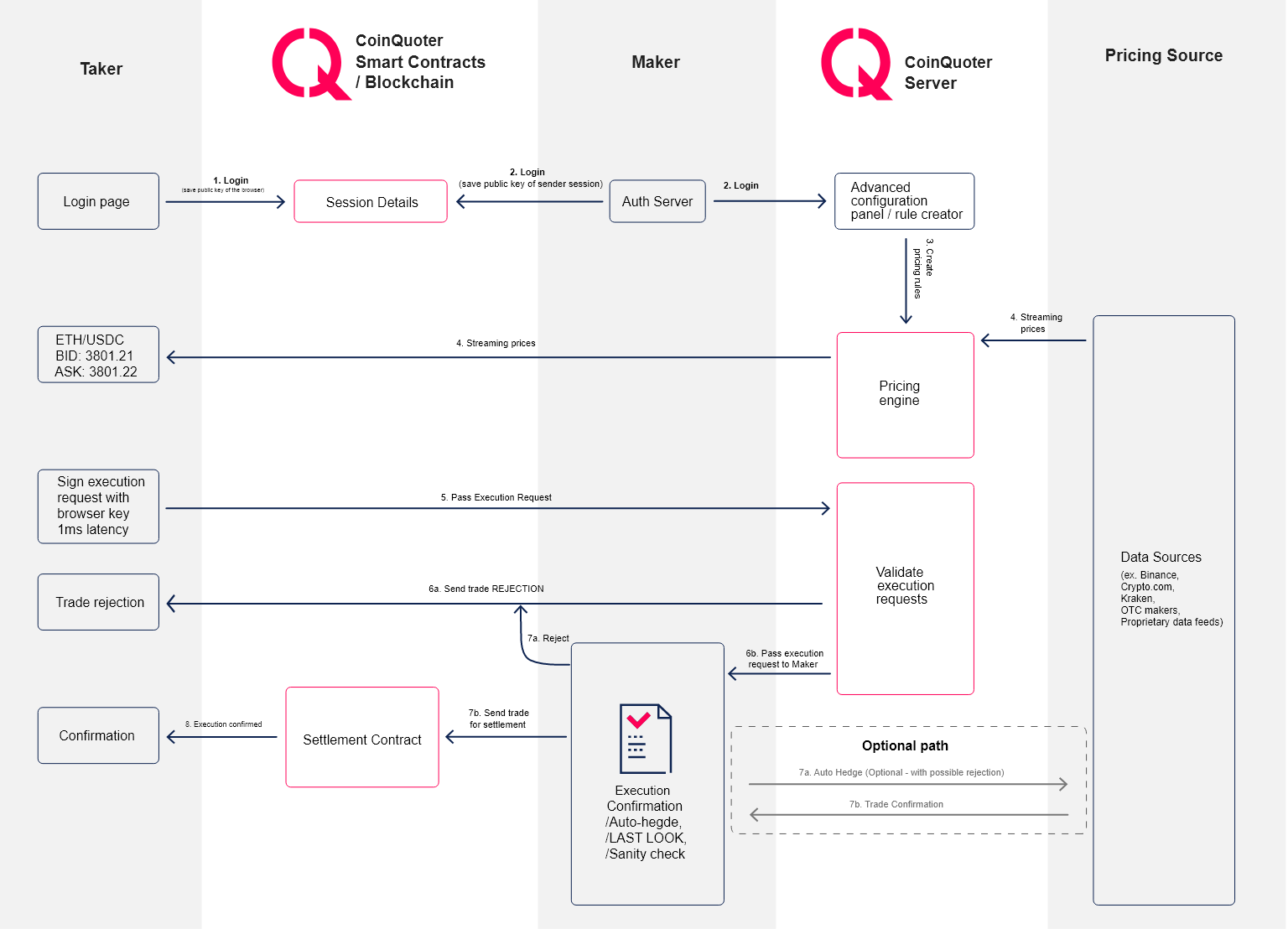

Process Overview

Pricing Engine

for

Market Makers

Market Makers

Our-of-the box

rule-based engine

rule-based engine

With CoinQuoter engine you can set up your pricing rules and maker fees based on a

pair, size, side, amount of tokens on your account, current market price, and current volatility

of the market. You are in control when your rules should be active and on which side of the market your liqudity if available.

Driven by 15 years of experience in building and managing FX

trading software in banks all over the world.

Easy start for takers

Full reporting of execution process

We are giving much more power to market makers than any other platform in the on-chain crypto space.

You will get detailed an audit trail containing every single system step with timestamps and quote

history 30 seconds before and after your trade request.

"Impermanent" Loss - Resistance

On-chain AMM liquidity model is

perfect for price discovery of illiquid

assets, but economically is very

inefficient and risky for both sides of

the trade. Often, most of the trading

activity in the pool is happening due to

the arbitrage between AMM and CEX,

leaving “Impermanent” loss much

bigger than fees earned from

transaction fees. With the CoinQuoter

model, you don’t lose your tokens due

to arbitrage. Trade requests are always

compared with the current market and

executed only, when the profit is within

system parameters that you have

defined.

Firm Rate Arbitrage - Resistance

OTC makers are not quoting sharply on on-chain OTC platforms like 1inch or Hashflow aggressively,

because they risk that the prices would change, when their quote signature is still valid in a 30-60

second window. We fixed this problem by turning around current workflows to give more power to the

makers that should not be afraid to quote. With our workflow the market maker is protected, because he

is the one that is getting signed execution requests from the customer and can validate if the current

market rate has not changed more than an acceptable slippage parameter.

Latency Arbitrage - Resistance

CLOB on Centralized Exchanges is also a very dangerous place to be a mid-size and small market maker

due to latency arbitrage. In most cases mid-size and small market makers are too slow to react to the

changing conditions and update orders in the order book. This makes maker orders effectively a taker

orders not giving a chance to earn any maker fees on CLOB and make a profit out of market maker

activity. We solve this problem by using data feeds to create prices of market makers and also prevent

latency arbitrage with Last Look (toxic trades that are trying to abuse the maker will be rejected).

First platform to support Last Look workflow for on-chain swaps

Significantly improves liquidity

Gives a chance to autohedge client flow on other venues

Protects against arbitrage

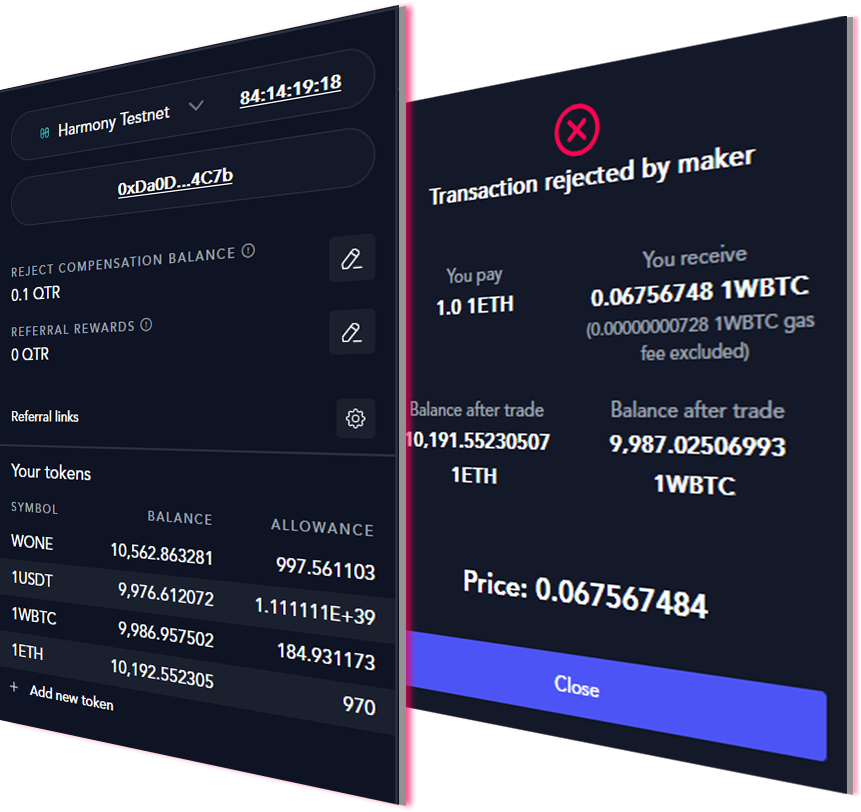

Last look

compensation

If a market maker will reject or not settle the trade without justified reason, you will get a

compensation that will be taken from the market maker account.

Off-chain pricing with on-chain settlement

Smart Contracts are very good for settlement, but to slow for efficient low lattency price discovery.

CoinQuoter is using technology, how it should be used.

Low Latency Execution

To provide the best rate possible Market Makers should get your execution

request within 50-250 ms from your click. For that reason, we created an on-chain session with a

design inspired by regular login workflow.

MEV-Resistance

Cryptographically signed execution requests makes any front-running

impossible. You are in charge of what your market maker can settle on-chain as a result of your

execution request.

Stop being anxious when executing your trades on-chain

Trade what you see the most efficient way possible

Trading session

Session is a unique concept designed by CoinQuoter to achieve low latency executions.

We found it impossible to assure low-latency execution with execution signatures generated by Metamask or a multisign process. To minimize the time between user requesting execution and market maker getting execution request, we decided to implement a session that in the first stage is saved directly on the blockchain.

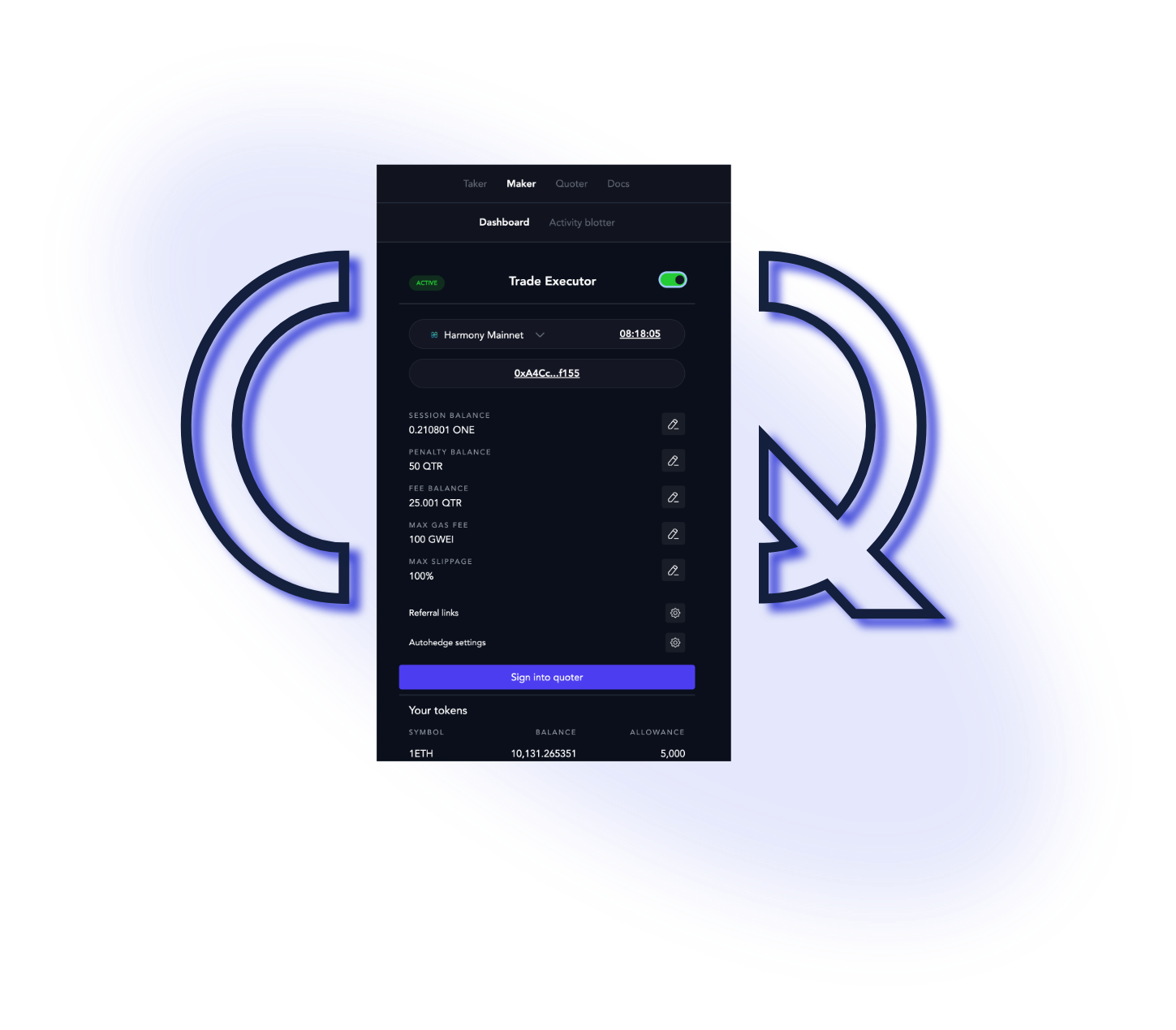

Sanity checks and final execution in hands of Market Maker

Maker panel that is pushing transactions to the blockchain is in your full control. You have

open-source

code, you can change it as you like. Current version of this panel is published on IPFS with ENS

domain.

In this panel we implemented a price check with Binance for every single execution. This is done on

top

of validations that we do on CoinQuoter. It slows down execution by around 500ms but allows us to

sleep

better. Turning off this panel is turning off your pricing and executions.

OTC Crypto Single Dealer Platform

Market maker can generate a special Single Dealer Exclusive link. Using this link a person will see

only your prices. This allows you to trade with your friends using your own prices.

CoinQuoter

Copyright © 2022 CoinQuoter